A joint post by Cheryl and Karen.

If you’re about to trim back your 2020 or 2021 guidance, you would be right to be a bit nervous about how the market is going to take it. But until you actually hit go on the press release, you have time to make subtle adjustments and learn from those who reported before you.

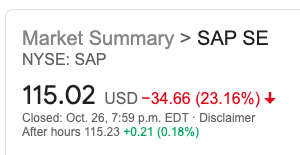

Enterprise software maker SAP took a drubbing in the markets yesterday, falling 23% after cutting its 2020 guidance and pushing out its mid-term guidance from 2023 to 2025. One would think with this sort of market reaction that the business was falling apart, but that seems to be far from the case.

Here’s the gist of SAP’s announcement:

- Cut revenue and operating profit ranges for 2020

- Pushed out mid-range revenue and profit targets by 1-2 years

- Dropped its margin outlook by 4-5 percentage points

It was not all bad news. SAP raised its cash flow outlook by almost 1 billion euros to 6.0 billion, and if there’s one thing that you don’t want to be short of in a pandemic, it’s cash.

Yet investors wiped 28 billion euros off the market cap of a company that has been lauded for its investor relations work. Every quarterly report creates a series of decisions, and some of these decisions can significant consequences for your stock price, for stakeholder confidence, for activist investors, for sales. If you peel back some of the decisions that SAP had to make, you may find some inspiration for your own quarter.

On what to say about guidance

In July, the company reaffirmed its 2020 and 2023 guidance, noting it had a strong second quarter, so much so that it pre-announced results 19 days early. Their confidence is predicting the future may already have been ebbing, but should they have signalled that in July, and risked precipitating a stock drop for something that might happen? Or should they have led with what they knew for sure, which is that 2020 results were coming as planned thus far.

This might feel like the glass half empty/half full question but given the stock drop yesterday, they may be wishing that they had talked a little more about the risks that they were monitoring, even if they didn’t see the need to adjust guidance earlier.

Here’s what the CEO Christian Klein actually said on the second quarter call in July:

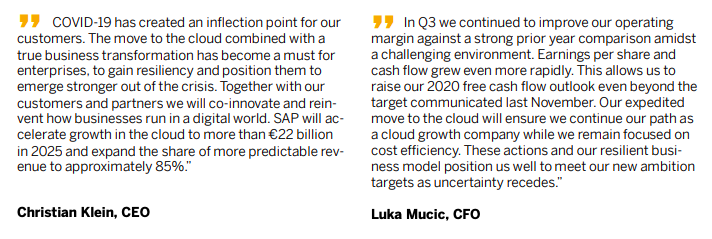

“Let me briefly comment on the midterm perspective. Our 2023 ambition remains unchanged from what we announced in Q1 because it continues to reflect our view as of today.

That said, we are in the process of updating our strategy. We are refocusing the company, identifying growth areas, evaluating additional business opportunities. We will be ready to give you an update at the Capital Markets Day towards the end of the year. We hope and expect that our assessment of the implications of COVID-19 on our midterm ambition will also be clearer then than it would be today.”

As recently as September, CFO Luka Mucic reiterated these targets on a conference platform and continued to give the impression that investors should expect more clarity towards year end. Yesterday, SAP announced the conclusion of that process on the earnings call (in lieu of the scheduled capital markets day), taking numbers down.

On prognosticating the future

As Klein refers to in the above quotation, SAP maintains a five-year “Ambition,” which is a great way to focus people on the longer growth strategy versus the day-to-day vagaries of the quarter. But they were in a tricky position, having given detailed mid-term targets to 2023 around that ambition.

While we think companies should start talking more about the mid-term outlook thus drawing investor obsession away from the quarter-to-quarter guidance, publicly putting hard numbers to your vision, versus focusing on the strategy and the evolution of the business may fit you with another straight jacket rather than achieving the goal of earning the right to invest in future growth.

And this is one area where investors are probably comfortable with directional indications or broader ranges right now, provided they can understand the metrics to watch along the way.

Talk about customer behaviour

SAP’s forecasts represent an acceleration of the shift of its business from traditional licencing revenues to cloud-based subscription revenue, which is less lumpy and more predictable. That was a trend already underway. Had the company done a good enough job at explaining the dynamics between the two business segments and what they needed to see to understand how fast that shift was happening?

Often the best way to explain these sorts of systemic shifts in your business is to talk about actual customers and their changing behaviour. The SAP team sad little about customer behaviour in the second quarter, so any early signs they have seen weren’t shared until they had hit critical mass in the third quarter.

Really, everyone knows that customer behaviour is shifting. Be careful about over-egging positive trends in a period of uncertainty. Talk about how Covid-19 is affecting your customers to allow people to think through the risks, even if it hasn’t hit your business yet.

Make every quote work hard

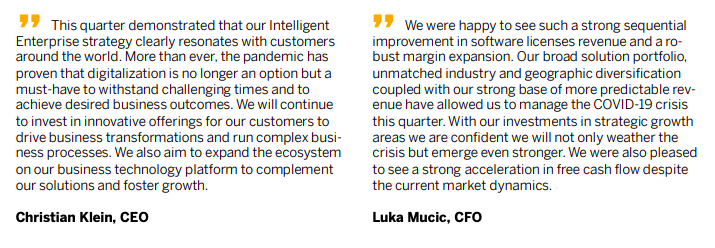

Don’t assume that everyone is reading your press release and your MD&A and listening to your conference call. Many people, particularly business media, are going no further than the quote you put in the release. So you need to make sure that every word counts. Compare the quotes from the second quarter and the third quarter. Do you feel like one quarter foreshadowed the next?

Particularly now, your stakeholders want to see how the CEO is leading, what choices you are making, and what you are worried about. You need to be accessible. Resist the urge to treat the quote like marketing key messages.

Those softer metrics matter

Investors want to have confidence in your “sustainable value creation” over the medium to longer term. Directing the conversation in that way what will keep investors with you. But if you are going to follow Klein’s lead to close with a statement about prioritizing “the success of our customers and the significant growth potential of SAP against short-term margin maximization” to ensure sustainable value creation, don’t miss an opportunity to link it to how you measure this success. Buried on page 7 of SAP’s release was a reaffirmation that its ”2020 targets for customer loyalty and employee engagement remain unchanged.”

Many companies are reluctant to treat these “soft” measures as important by continuing to talk about them during tough times, and SAP lost an opportunity to explain why these metrics matter during a pandemic. Perhaps they don’t really care about these non-financial metrics, or perhaps the executive team thinks that investors won’t care or doesn’t want to be seen glossing over the financials.

But maintaining customer loyalty and employee engagement are critical right now to get companies through the pandemic and are critical to SAP’s goal of increasing its predictable revenue base. If those metrics are indeed performing well, SAP could have more strongly made the link for its listeners and readers as to why they believe that, despite the systemic changes happening to the company, its outlook is credible.

Would making different decisions on any one of these things softened the losses that SAP suffered today? Perhaps not. How much can the market absorb on a quarterly earnings call, rather its previously planned end of year Capital Markets Day, and was the company right to use the earnings call to announce a major shift to mid term targets? Hard to say.

Do the results simply reflect an acceleration of a shift to cloud and a change by a fairly fresh CEO that might have happened anyway? Probably. But the impact of SAP’s results announcement – the worst one-day decline in the last 20 years and trading volumes 10x the average daily volumes – serves as a warning to companies in the last weeks of their quarterly preparation. Investors are watching and not giving anyone a free pass. Whereas in March and July investors were prepared to wait and see, this quarter is going to be different.

They want to know how you have pivoted. They want to know what trends you are watching. They want to know what Plan B and C look like. You need to be better this quarter.

Karen helps executive teams report and engage with stakeholders around issues that are material to their business. She is opinionated (in two languages) about how investor focus on ESG will change how companies access capital. You can reach her here.